All businesses that pay staff may need to pay statutory sick pay if an employee is unable to work due to sickness.

What is statutory sick pay?

Statutory sick pay (SSP) is an amount that is payable by employers to eligible employees (it cannot be paid to women who are receiving statutory maternity pay or maternity allowance). To see if an employee qualifies for SSP a YES answer is required for ALL of the following questions*.

| Question | Detail | Notes |

|---|---|---|

| 1. Does the employee have a contract of employment? | The employee must have done some work under that contract. | |

| 2. Does the employee earn at least £123 per week? | If the employee is paid an irregular amount the average weekly earnings of the last eight weeks must be calculated. | |

| 3. Has the employee been off sick for more than three days in a row? | This includes the days they don’t usually work. | |

| 4. Has the employee given you the correct notice? | This is a maximum of seven days unless their contract states otherwise. | You don’t have to pay SSP for any of the days the employee was late in telling you. |

| 5. Has the employee given you proof of their illness? | This is required after seven days of absence and is called a fit note. They are provided by doctors (hospital or GP) and state either “not fit for work” or “may be fit for work”. Alternatively a “return to work plan” from the fit for work scheme can be accepted instead. | You still have to pay SSP for any of the days the employee was late in sending you the fit note. |

*Question 5 only applies for absences of seven days or more.

A form called SSP 1 must be completed if the employee is not eligible. The employee may receive the Employment and Support Allowance instead.

How much is statutory sick pay?

Statutory sick pay (SSP) is £116.75 a week for up to 28 weeks. This can be paid at a daily rate.

When do I have to pay statutory sick pay?

As an employer you pay SSP as follows:

-

![Working on a laptop with breakfast]()

Qualifying days

These are the days an employee usually works. For example – Monday, Tuesday, Wednesday, Thursday, Friday. SSP is only payable if an employee is off sick on a qualifying day.

-

![Thermometer and pills]()

Waiting days

These are the first three days an employee usually works and has been off sick. For example – Monday, Tuesday, Wednesday, Thursday, Friday are the qualifying days, the employee is off sick from Monday, therefore Monday, Tuesday and Wednesday are waiting days. SSP is not payable for the waiting days.

-

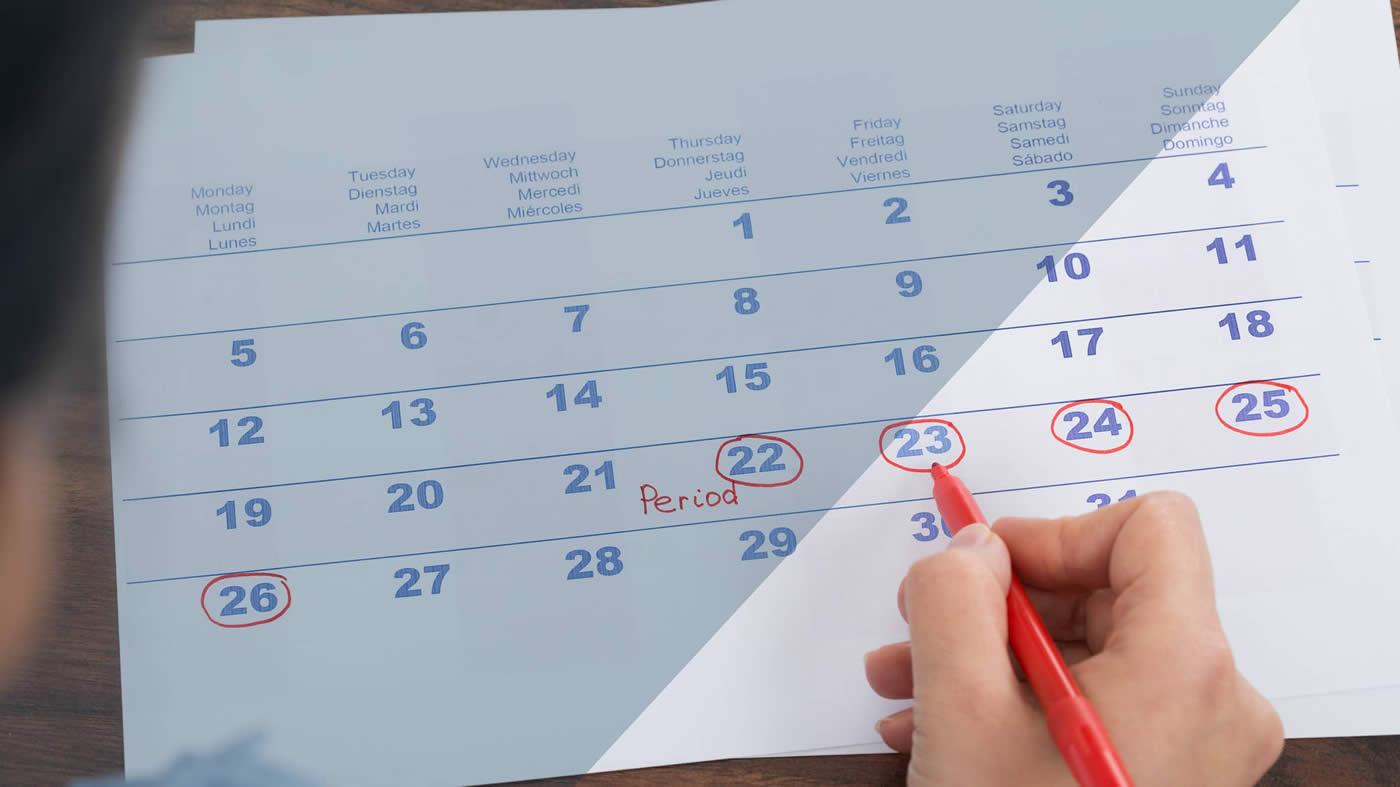

![Calendar with dates circled]()

Fourth qualifying day

SSP will be paid from the fourth (qualifying) day of sickness. For example – Monday, Tuesday, Wednesday, Thursday, Friday are the qualifying days, the employee is off sick from Monday, therefore Monday, Tuesday and Wednesday are waiting days and SSP is paid from Thursday.

-

![Pound coins stacked]()

Linked periods

There are no waiting days for a linked period of sickness; this means periods of four days or more within the last eight weeks.

-

![Writing and working on laptop]()

28 weeks

SSP is payable for a maximum of 28 weeks, after that time a form called SSP 1 must be completed and the employee may be eligible for the Employment and Support Allowance instead.

How do I pay statutory sick pay?

SSP is payable to employees in the usual way that their salaries and wages are paid. Income tax and national insurance may be deducted under the normal rules.

For those employees who are not eligible for SSP or have a long term sickness (over 28 weeks) you must send the employee a form SSP1 within seven days.

It is advisable to keep records of SSP paid and dates of sickness absences.

This tool from GOV.UK may help you to calculate statutory sick pay.

Share this content

Brought to you by:

AAT Business Finance Basics

AAT Business Finance Basics are a series of online e-learning courses covering the core financial skills every business needs. They draw from AAT’s world-leading qualifications and will quickly build your knowledge on key topics including bookkeeping, budgeting and cash flow.

Visit partner's website