Professional indemnity insurance (PI) is not compulsory, but it’s seen as essential for many businesses. Here’s what this form of insurance covers and the types of business that need it.

What is professional indemnity insurance?

Professional indemnity insurance is designed to protect you from claims for financial losses suffered by your clients resulting from services or advice you’ve given them. It can cover the legal fees of defending a claim and compensation payments to the claimant.

When all’s going well with a client it can be hard to envisage a situation where they decide to sue you. However, even the best relationships can be shattered if what you provide does not meet the client’s expectations, or worst still ends up losing them money.

What does professional indemnity insurance cover?

This type of insurance can cover you against:

- claims for breaches of professional duty

- copyright and confidentiality

- negligence

- loss of information

- defamation.

Here are examples of some of these. Imagine what would happen if any of these businesses did not have professional indemnity insurance to pay damages and legal costs.

-

![Working on prototype]()

Mike – Architect

Mike designs an extension to a professional kitchen. His customer contracts a builder to construct the extension, but a few months after it’s finished bad cracks appear. The customer calls out a surveyor who says that there’s a problem with the way the extension has been designed; it needs to be pulled down and rebuilt. The customer sues Mike for the money he has lost because of the rebuild and the disruption to business – £175,000.

-

![Looking at plans]()

Marcia – Training Consultant

Marcia is commissioned to write a training manual for the apprentices of a large company. The manual is then printed and distributed throughout the company’s many offices around the country. Unfortunately, a mistake is discovered in what Marcia has written; all the manuals need to be withdrawn and replaced with ones that have the error corrected. The company sues Marcia for the costs of pulping and recycling the incorrect manuals and for the printing and distribution of the replacements (£30,000).

-

![Chatting on phone]()

Alex and Kevin – Web Designers

Alex and Kevin design a website for a client. They use some photographs that they believe are copyright free. However, the client is sued by the owners of the photographs as Alex and Kevin have not obtained the correct licences. The client in turn sues Alex and Kevin for £8,000.

-

![Working out]()

Sven – Personal trainer

Sven creates a fitness routine for one of his customers. The customer follows the routine for several months but develops severe and debilitating back pain, which means she cannot work for a number of weeks. The customer goes to see several osteopaths, who put her condition down to inappropriate exercise recommended by Sven. The customer sues Sven for £7,500 the cost of treatment and lost earnings.

-

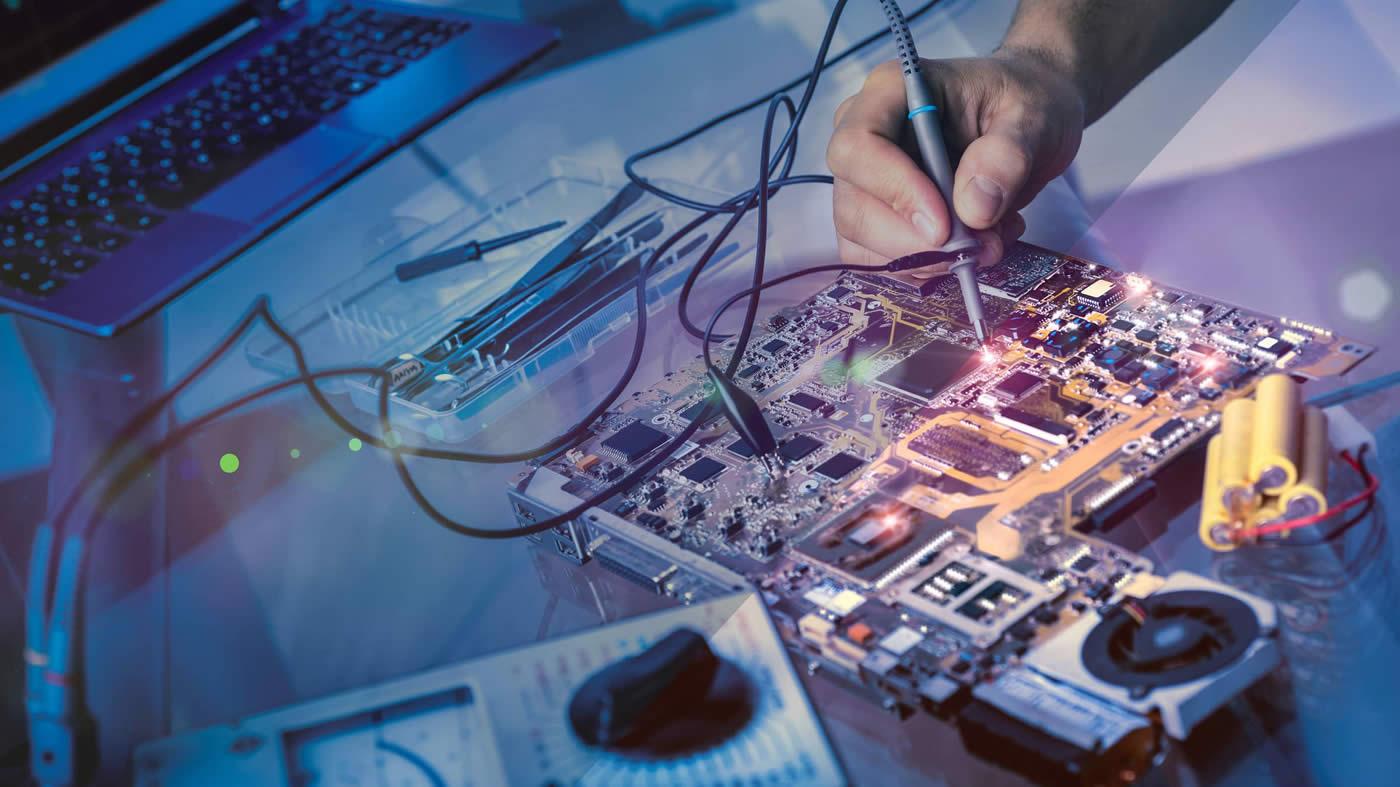

![Logicboard]()

Bina and Justin – IT specialists

Bina and Justin’s business is contracted to create a complex software package for a client. Despite their best efforts the software package is delivered late and has many deficiencies; it fails to meet the client’s requirements in many ways. Bitterly disappointed, the clients sue Bina and Justin for £400,000 to recover the fees they’ve already paid and the disruption to their business.

-

![Networking]()

Jackie – Events Organiser

Jackie finds out that a venue she uses regularly is having severe financial problems. She warns people in her network about this and several of them cancel bookings and stop making new bookings with the venue as they’re worried about losing money if it becomes insolvent. The venue gets wind of this and sues Jackie’s business for defamation.

What types of businesses need professional indemnity cover?

If you provide services or give advice you should think seriously about having professional indemnity cover. Some professional bodies will require you to have this before they accept you. Here are examples of some of the businesses who usually need professional indemnity insurance:

|

Actuaries Accountants Advertising Agents Architects Auctioneers Conference Organisers Designers Educators Engineers |

Estate Agents Financial Advisors Fitness Instructors Healthcare professionals IT Consultants Management Consultants Quantity Surveyors Researchers Safety Consultants |

Solicitors Sports coaches Stockbrokers Surveyors Therapists Travel agents Tour operators Valuers

|

How much professional indemnity insurance cover do I need?

Some professional bodies or clients will specify the level of cover you need. For example, solicitors must have professional indemnity cover of at least £3 million for any single claim made against them. But if you have to decide the level of cover yourself, think about what may happen if things turn sour.

A client may demand compensation to cover the money they’ve paid you. This is bad enough but it could be just the tip of the iceberg. They may also pursue you for the cost of rectifying any problems that are a result of your negligence. If your work is part of a multi-faceted project and your mistake has had a chain reaction elsewhere, they may sue you for their total loss, including profits they might have been expected to make if things had gone to plan.

Your client may also demand that you cover the cost of their legal action against you. You also need to take into account your own legal costs in defending yourself – these might run into many thousands.

And make sure that you maintain the right level of cover. Most claims would be for work you’ve already done but these will be subject to your current level of cover, not the amount you were covered for when you carried out the work.

How long should I keep up my professional indemnity insurance?

Professional indemnity insurance normally only covers you for claims that are made during the term of your policy. If a claim is made against you after the policy has expired – even if it relates to work you did when the policy was in place – you will not be covered.

For instance, say you provided services to a client in 2018 when you had PI cover. However, in 2020 the client makes a claim against you regarding this work. If you’ve allowed the policy to expire or not taken out another one your insurer will not cover you.

So if you are retiring or changing your business you need to think seriously about purchasing a ‘run-off policy’. This would cover you for any new claims against you after your professional indemnity insurance has expired. New claims can be brought against you for up to six years after the date of an alleged mistake or negligent action so make sure a run-off policy covers you for this length of time.

How much does professional indemnity insurance cost?

This depends on factors such as the following:

- The level of cover you require – cover for £10 million will obviously cost more than cover for £100,000

- Your volume of work – the more contracts you have, the higher the chance you’ll face a claim – the higher the chance of a claim, the higher the cost of the policy

- The value of your contracts – the higher the value the higher the premium

- Your type of business – some sectors are inherently more risky than others. For example, the financial impacts of something going wrong in IT contracting, are likely to be more significant than for training consulting.

Where can I buy professional indemnity insurance?

You can get professional indemnity insurance direct from an insurer or through an intermediary such as a broker.

No matter who you buy your insurance from, ensure that they have a good knowledge of your particular business sector. This is especially true when it comes to professional indemnity insurance, as they need to understand the risks associated with the types of clients you work with and the nature of your contracts in order to pin-down the appropriate amount of cover.

To check that an insurer is properly authorised check the website of the Financial Conduct Authority (FCA).

Share this content

Brought to you by:

AAT Business Finance Basics

AAT Business Finance Basics are a series of online e-learning courses covering the core financial skills every business needs. They draw from AAT’s world-leading qualifications and will quickly build your knowledge on key topics including bookkeeping, budgeting and cash flow.

Visit partner's website