Small businesses are often referred to as the ‘lifeblood of the economy.’

Despite this, business leaders, entrepreneurs and small businesses were left disappointed by today’s Budget announcements.

We took to Twitter to investigate the fallout from the Budget and what it means for business owners. We’ve also added our own Informi take on each of the announcements. You’ll be pleased to know, we correctly predicted all of them.

Business rates

Early on in his speech to the House of Commons, the Chancellor addressed what many business groups have been calling for.

The three measures to ease the rates burden on businesses drew a mostly positive response.

Not everyone was convinced it would make a big difference.

What Informi said:

We welcome the measures announced today to help those who will be most affected by rate rises; in the age of online shopping we live in now, it is important that the smallest businesses are not penalised by high costs for continuing to help keep our high streets open.

National Insurance Contributions

The Budget is often used as a way to address perceived disparities in the tax system.

For that reason, we weren’t surprised when the Chancellor announced measures to raise NICs for the self-employed.

That means more money in the treasury’s coffers and less in the pockets of self-employed workers.

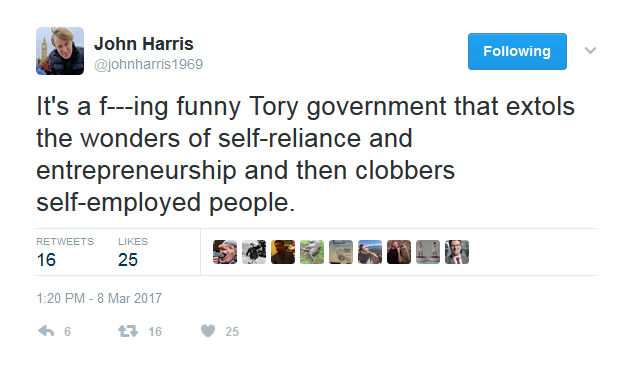

No one tends to mind when it’s large multinationals being targeted. This measure was seen to be going after the regular hard-working self-employed folk.

And some commentators were especially critical…

What Informi said:

We are pleased to see a threshold in place so only those with profits above £16,250 will have to pay more NICs. However, although we recognise the need for ‘fairness’ in the tax system between the employed and self-employed, the rise in NICs added to the reduction in the tax free dividend allowance may have many entrepreneurs concerned that the government has gone back on its manifesto pledge not to raise personal taxes.

Broadband and infrastructure

A lot has been made of the UK living within its means and tackling the £1.7 trillion deficit. The Chancellor admitted this would be hard with UK productivity lagging as it currently is.

Infrastructure = improving internet connectivity. A fixture in every Budget it seems.

This is a particularly prominent issue for rural-based businesses.

Away from the broadband rollout other infrastructure announcements were less eye-catching

What we said:

It is more important than ever that businesses have an online presence to help them market their products and services. Therefore, small business owners will welcome the announcement that they can now receive full-fibre broadband vouchers worth up to £3,000. This should help businesses who struggle to get fast connections and a suitable broadband service in their area. Research we recently carried out into the best cities in the UK to start a business showed that there are still too many areas where broadband provision is substandard, which is unacceptable in one of the richest countries in the world.

Making Tax Digital

It wasn’t one of the headline announcements but provided welcome relief for smaller businesses.

This was welcomed by campaigners who argued the April 2018 deadline was too tight for many SMEs.

What we said:

A date of implementation for Making Tax Digital of April 2018 seemed too tight, and some worried that it would not give all businesses enough time to prepare for the change. We have heard from our users, who are individuals running small and micro businesses, and many of them are still not properly aware of MTD and what actions they need to take for it. Therefore, the Chancellor’s announcement of a delay of a year for unincorporated businesses and landlords with turnover below the VAT threshold will be welcomed. However, a larger awareness campaign may be needed to ensure that all businesses are aware of what they need to do.