It might have felt like there wasn’t much for us to smile about in 2017, but look beyond the political uncertainty around the world and there’s plenty of positive developments to cheer small businesses.

We’ve picked out seven reasons to be cheerful in 2018.

1.There will be some big economy-boosting events

In case you hadn’t heard, Prince Harry will be marrying Meghan Markle on 19 May 2018.

Regardless of whether you’re a paid-up royalist, for tourism and hospitality this is good news. According to the Office for National Statistics, 800,00 more tourists visited the UK in the year of William and Kate’s wedding in 2011, compared to 2010. The fall in the value of the pound since Brexit makes the UK an even more attractive destination for cost-savvy tourists.

The feel-good factor (who doesn’t love a good wedding?) will also be good news for retail – particularly for those in the business of commemorative trinkets.

Some are disappointed that Downing Street has insisted the date will not be made a public holiday. However, as bank holidays lead to an inevitable drop in productivity, this will turn out to be a good thing for the UK economic output overall.

2018 is also World Cup year, so there will be plenty of marketing opportunities to tie in with the big sporting event of the summer. Businesses, as well as fans, will be hoping for England to do better than the last World Cup and make it out of the group stages.

A prolonged World Cup campaign + a burst of summer weather = good news for business (OK, the odds don’t look too great there)

To help you capitalise on these and other events, we’ve put together this handy guide to planning your business year.

2. You’re in good company

The UK has a long tradition of entrepreneurship and continues to lead the charge compared to other developed Western nations.

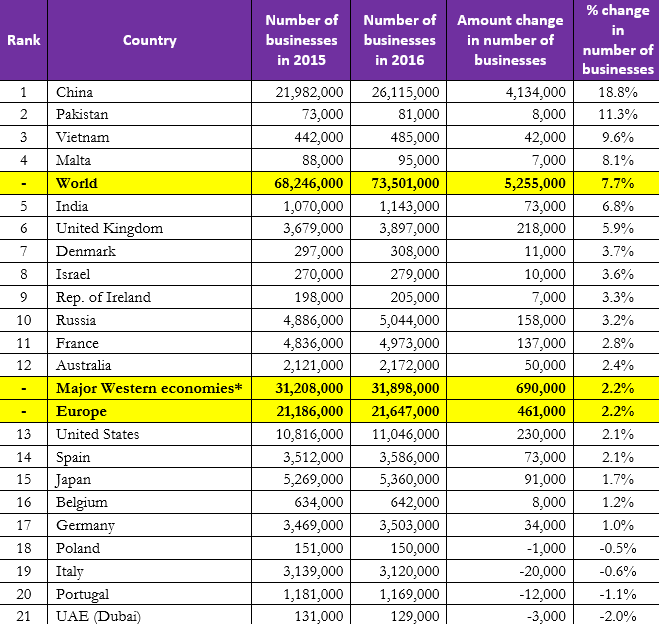

According to research from Chartered Accountancy group UHY Hacker Young, the UK came out top of all major developed economies for establishing new businesses.

Source: UHY Hacker Young

Indeed, there was an increase of 5.9% in the number of companies being founded in the United Kingdom from 2015 to 2016. The country also topped the Forbes’ Best Countries For Business 2018. The strongest performances areas were technological readiness and size and education of its workforce. And if you’re wondering where the best place is to start and run a business in the UK, Informi’s 2017 research revealed some slightly surprising conclusions.

3. You’re helping to close the Gender Pay Gap

Give yourselves a big pat on the back for your contribution to gender equality. Recent research by Informi shows small businesses are leading the way in closing the gender pay gap across a number of industries in the UK. If the trends continue in 2018 and beyond, wage equality across these industries will be achieved by 2034.

“Smaller businesses are not burdened by layers upon layers of communication and decision-making,” says Anna Skopets, founder of TreeVitalise. “They are agile and flexible, and either set up or employ millennials whose understanding of the changing role of women in the professional workplace differs from that of their parent’s generation.”

But, there’s still work to do. “For gender pay equality to stop being an issue, we should be seeing more women taking senior managerial roles. It’s at the board level that things need to change.”

4. Open Banking will make finance fairer for SMEs

Open Banking will commence in 2018, which aims to level the playing field between the UK’s ‘big six’ banks and the rest of the UK’s SME lenders, leading to a fairer, more competitive market.

The Competition and Markets authority concluded in 2016 that the lack of competition meant SMEs were paying too much for banking services and products and were being left behind with new technologies.

So, in a nutshell, Open Banking should make banking easier for small businesses, whilst also providing a boost to the UK’s blossoming fintech industry.